Spain’s Energy Landscape

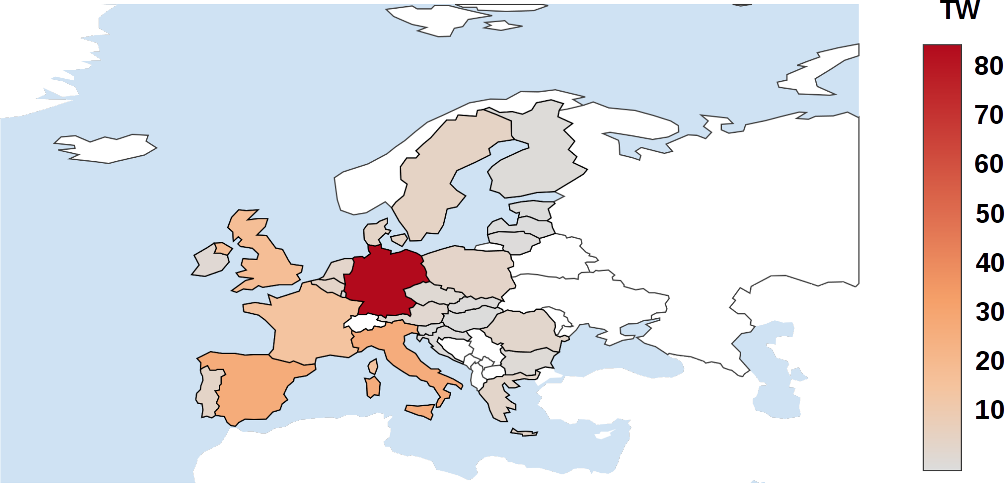

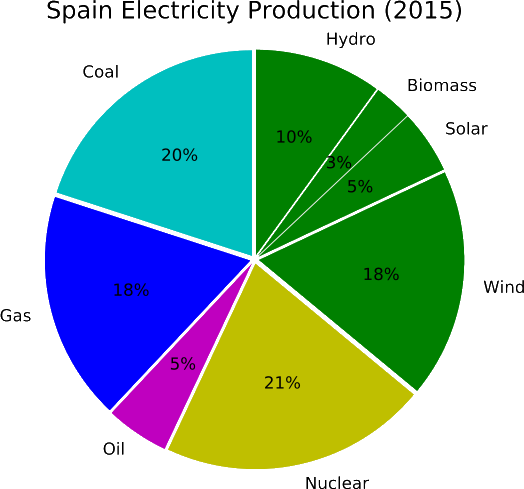

In our previous post we reported on the prospects of energy storage in Denmark. Now we are moving back south. While it is commonly assumed that solar is the key driver of renewable energy production in Spain, wind represents more than three times the energy production than solar − Spain is a world leader in wind power. In 2014, Spain had the 4th most installed wind capacity, globally and wind energy accounted for 18% of total Spanish electricity production in 2015. Gas and coal still make up over one-third of electricity production in Spain.

While fuel oil is still used for electricity in Spain, it should be noted that this is exclusive to the non-peninsular areas of Spain (i.e. Canary Islands, Balearic Islands, Cueta, Melilla, and several other small islands).

By 2020, 20% of Spain’s final energy consumption must come from renewable energy sources – as mandated in the 2009 EU Directive 28. However, Spain will likely miss this target. In the early 2000’s Spain was a global leader in renewable energy. For example, in 2005 Spain became the first country to mandate PV installations on all new buildings and ranked 5th globally in total renewable energy investments. However the renewable energy industry has stagnated significantly over the past decade. Unfortunately, Spain, which drove the global market in 2008, has virtually disappeared from the PV picture due to retroactive policy changes and new tax on self-consumption.

The policy changes and self-consumption taxes allude to the Royal Decree 900/2015 on self-consumption, a law enacted by the Spanish government in October 2015, which aims to financially penalize the self-consumption of electricity. Under the new law solar PV producers (residential PV owners, for example) are required to not only pay a tax on the energy they self-consume, but also must pay the same transmission & distribution fees they would have paid on an equivalent amount of electricity purchased from the grid. In addition to these charges and taxes, owners of systems 100 kW and smaller – most residential system owners – are prohibited from selling excess electricity from the grid. Instead, they must give it to the grid for free. Furthermore, this law is retroactive; meaning existing PV systems must comply or face a penalty. Penalties under the self-consumption law range from as low as EUR 6-million up to a maximum of EUR 60-million – about twice the fine for leaking radioactive waste. The Spanish government see’s self-consumption as a risk to tax revenues at the current high electricity prices.

Spain is still the world leader in concentrated solar power capacity (2.5 MW). However, no new plants were constructed since and there are currently no new plants under construction or in planning.

Energy Storage Market Outlook – Spain

Although initial drafts of the “self-consumption” law had strict provisions against battery storage systems, the final version does permit energy storage systems – although under conditions that make them impractical. While owners of solar-plus-storage systems are subject to additional charges, they also cannot reduce the amount of power that they have under contract from their utility company.

At this point in time, it appears as if the self-consumption law has effectively halted any investment in renewable energy and/or energy storage projects in Spain.

(Jon Martin, 2019; Photo: Wikipedia)