Italy’s Electricity Portfolio

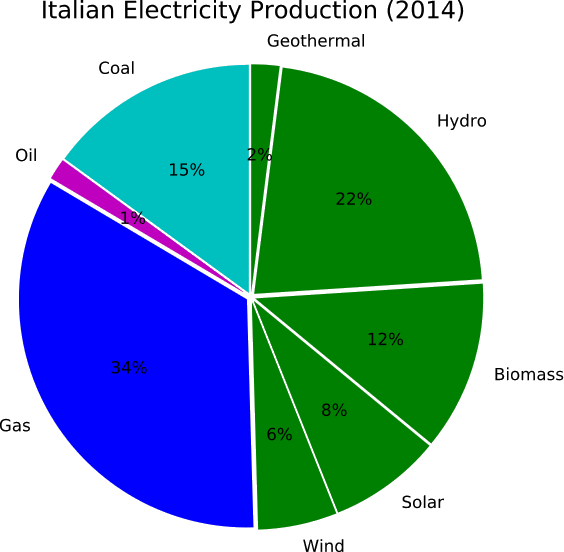

In our previous post we briefed you on the energy storage potential in the United Kingdom. With Brexit, Italy will become the third largest member state after Germany and France. With extensive mountain terrain in the north, Italy has long been dependent upon hydroelectric generation. Until the mid 1960s hydropower represented nearly all electricity production in Italy. The installed capacity of hydropower has been stagnant since the mid 1960s, with a rapid growth in fossil fuel based generation driving the overall share of hydropower fall from ~90% to 22% in 2014. A detailed breakdown of electricity sources in Italy is shown below.

Considerable effort has been made to transition Italy to a low carbon electricity sector. As of 2016, Italy had the 5th highest installed solar capacity in the world and the 2nd highest per capita solar capacity, behind only Germany. In addition to its impressive solar progress Italy ranks 6th worldwide in geothermal with 0.9 GW.

Italy’s solar growth was propelled by feed-in-tariffs that wer enacted in 2005. This provided residential PV owners with financial compensation for energy sold to the grid. However, the feed-in-tariff program ceased on 06 July 2014 after the €6.7 billion subsidy limit was reached.

Even with its impressive accomplishments in renewable energy, traditional thermal generation (natural gas) still account for ~60% of total electricity generation in Italy. How much effort will go into reducing this number is still unclear. Italy has committed to 18% renewables by 2020 and is nearly 70% of the way there already so there is little urgency on reducing fossil-based electricity from the perspective of meeting this target. However, Italy is heavily reliant on fossil fuel imports (Deloitte) and energy security requirements will likely continue to push the development of more domestic electricity sources like renewables.

Energy Storage Facilities

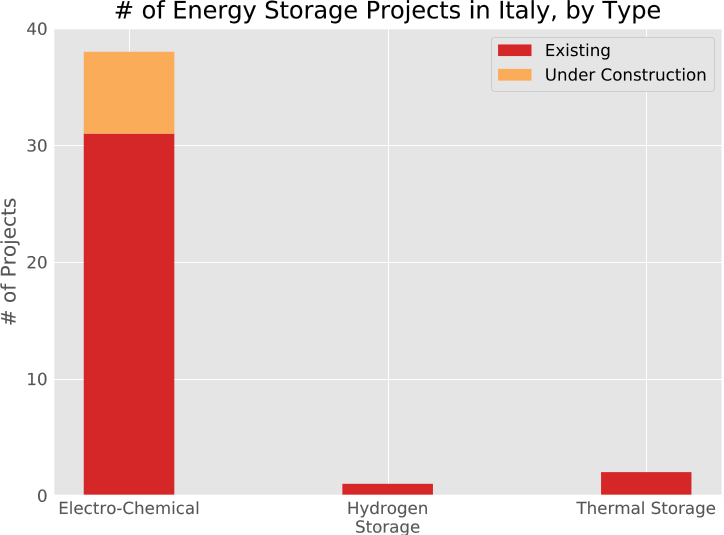

Italy is dominating the electro-chemical energy storage market in Europe. With over 6,000 GWh of planned and installed electro-chemical generating capacity (~84 MW installed capacity), Italy is far ahead of 2nd place UK. This is largely due to the massive SNAC project by TERNA (Italy’s TSO), a sodium-ion battery installation totaling nearly 35 MW over three phases. A breakdown of energy storage projects, by technology type can be seen below.

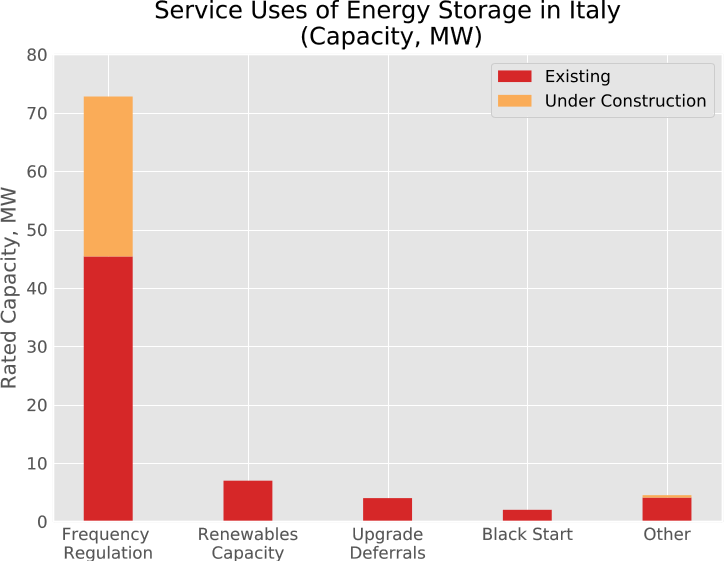

Service Uses of Energy Storage

In Italy, electrical energy storage is used almost exclusively for grid support functions; mainly transmission congestion relief (frequency regulation). While it may not be a direct case of renewables firming, congestion issues can be traced to the variability of solar power, meaning electrical energy storage development in Italy is largely driven by the need to integrate solar power.

Energy Storage Market Outlook

Italy is one of the top markets in the EU for energy storage and is primed for growth. The Italian TSO, TERNA, has been investigating selling energy storage as a service. In 2014 the AEEG, the electrical regulator under which TERNA operates, proposed that batteries should be treated as generation sources similar to cogeneration plants. Italy has always been a market completely dominated by a small number of big centralized utility companies and this trend is likely to continue when it comes to EES deployment. These companies have been focusing their efforts on battery technologies and are expected to continue down this path.

However, the private market could present great opportunity for P2G. The International Battery & Energy Storage Alliance have summarized the reality of Italy’s untapped energy storage market as follows: “With high solar output of 1,400 kWh/kWp, net residential electricity prices around 23 cent/kWh and currently no FIT, the Italian energy market is considered to be highly receptive for energy storage.”

Italy is now well-stocked with residential PV systems that can no longer collect subsidies. Combine this with the fact that the vast majority of homes in Italy burn natural gas imported from Russia, Libya and Algeria and it is clear that Italy presents a unique opportunity for P2G at a residential/community level. This is echoed by Energy Storage Update who in 2015 concluded that Italy was “one of the top four markets worldwide for PV-and-battery-based energy self-consumption.”

While it is unclear exactly how many residential PV systems there are in Italy, it was speculated in late 2015 that there were over 500,000 PV plants in Italy.

In our next post, we are looking at the situation for energy storage in Denmark.

(Jon Martin, 2019)