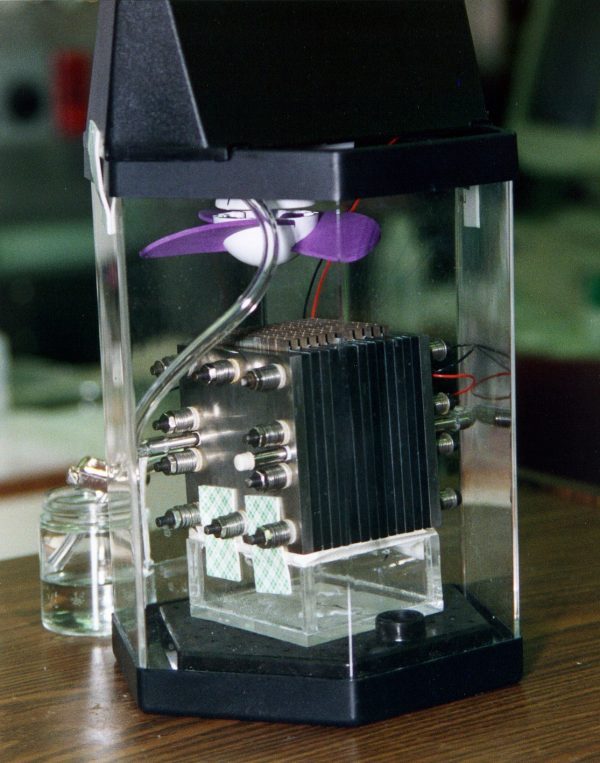

In addition to well-established Nafion™ membranes which are currently the best trade-off between high-performance and cost in proton exchange fuel cells (PEM), methanol fuel cells, electrolysis cells etc. As our energy resources are diversifying, there is a growing demand for efficient and selective ion-transport membranes for energy storage devices such as flow batteries.

Redox flow batteries – the energy storage breakthrough

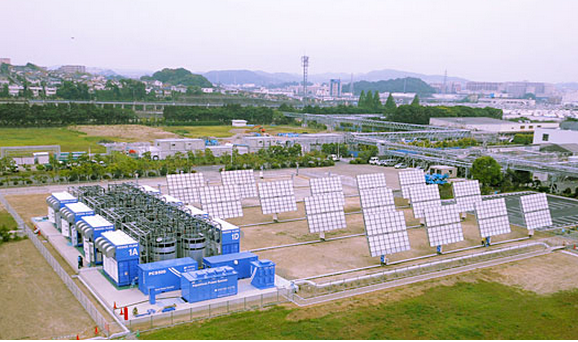

The high demand for a reliable and cost-effective energy storage systems is reflected in the increased diversity of technologies for energy storage. Among different electrochemical storage systems, one of the most promising candidates are redox-flow batteries (RFBs). They could meet large-scale energy storage requirements scoring in high efficiency, low scale-up cost, long charge/discharge cycle life, and independent energy storage and power generation capacity.

Since this technology is still young, the development of commercially and economically viable systems demands:

- improvement of the core components e.g. membranes with special properties,

- improvement of energy efficiency

- reduction in overall cost system.

Meeting demands for redox flow batteries

Two research teams in the United Kingdom, one from Imperial College and the other from the University of Cambridge, pursued a new approach to design the next generation of microporous membrane materials for the redox-flow batteries. They recently published their data in the well renown journal Nature Materials. Well-defined narrow microporous channels together with hydrophilic functionality of the membranes enable fast transport of salt ions and high selectivity towards small organic molecules. The new membrane architecture is particularly valuable for aqueous organic flow batteries enabling high energy efficiency and high capacity retention. Importantly, the membranes have been prepared using roll-to-roll technology and mesoporous polyacrylonitrile low-cost support. Hence, these innovative membranes could be cost effective.

As the authors reported, the challenge for the new generation RFBs is development of low-cost hydrocarbon-based polymer membranes that features precise selectivity between ions and organic redox-active molecules. In addition, ion transport in these membranes depends on a formation of the interconnected water channels via microphase separation, which is considered a complex and difficult-to-control process on molecular level.

The new synthesis concept of ion-selective membranes is based on hydrophilic polymers of intrinsic microporosity (PIMs) that enable fast ion transport and high molecular selectivity. The structural diversity of PIMs can be controlled by monomer choice, polymerization reaction and post-synthetic modification, which further optimize these membranes for RFBs.

Two types of hydrophilic PIM have been developed and tested: PIMs derived from Tröger’s base and dibenzodioxin-based PIMs with hydrophilic and ionizable amidoxime groups.

The authors consider their approach innovative because of

- The application of PIMs to obtain rigid and contorted polymer chains resulting in sub-nanometre-sized cavities in microporous membranes;

- The introduction of hydrophilic functional groups forming interconnected water channels to optimize hydrophilicity and ion conductivity;

- The processing of the solution to produce a membrane of submicrometre thickness. This further reduces ion transport resistance and membrane production costs.

Ionic conductivity has been evaluated by the real-time experimental observations of water and ion uptake. The results suggest that water adsorption in the confined three-dimensional interconnected micropores leads to the formation of water-facilitated ionic channels, enabling fast transport of water and ions.

The selective ionic and molecular transport in PIM membranes was analyzed using concentration-driven dialysis diffusion tests. It was confirmed that new design of membranes effectively block large redox active molecules while enabling fast ion transport, which is crucial for the operation of organic RFBs.

In addition, long-term chemical stability, good electrochemical, thermal stability and good mechanical strength of the hydrophilic PIM membranes have been demonstrated.

Finally, it has been reported that the performance and stability tests of RFBs based on the new membranes, as well as of ion permeation rate and selectivity, are comparable to the performances based on a Nafion™ membranes as benchmark.

(Mima Varničić, 2020, photo: Wikipedia)